-

Maximizing Sales Productivity with Real-World AppSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%90%Accuracy on

Maximizing Sales Productivity with Real-World AppSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%90%Accuracy on from data collection & cleansing to the seamless deployment of advanced machine learning models80%Churn Prediction86%Optimizationfor Fraud DetectionSales ForecastingAccuracy onCustomerSegmentation

from data collection & cleansing to the seamless deployment of advanced machine learning models80%Churn Prediction86%Optimizationfor Fraud DetectionSales ForecastingAccuracy onCustomerSegmentation

Driving Sales Excellence: How AI Tools Elevate Team Performance?

By leveraging AI-driven insights and automation, sales teams can boost productivity, increase efficiency, and drive better results. From predictive analytics for sales forecasting to AI-powered chatbots for customer support, these real-world applications empower sales professionals to excel in their roles and achieve greater success in today’s competitive market landscape.

The AI Platform Tailored for

Sales Professionals

Sales Forecasting

papAI offers advanced predictive analytics capabilities to analyze historical sales data, market trends, and other relevant factors to forecast future sales accurately.

papAI allows users to create customizable forecasting models tailored to their specific business needs, such as seasonal trends, product variations, or regional differences.

papAI enables scenario planning by simulating various sales scenarios based on different assumptions, such as changes in market conditions, pricing strategies, or product launches.

Churn Prediction

papAI employs survival analysis techniques, such as Cox Proportional Hazards models or Kaplan-Meier estimators, to model customer lifetimes and predict the likelihood of churn over time, taking into account censoring and time-dependent covariates.

papAI incorporates anomaly detection algorithms, such as isolation forests or autoencoders, to identify unusual or anomalous customer behavior that may indicate imminent churn, enabling proactive intervention.

papAI provides interpretability features such as SHAP (SHapley Additive exPlanations) values or LIME (Local Interpretable Model-agnostic Explanations) to explain the factors contributing to churn predictions and enable better decision-making by stakeholders.

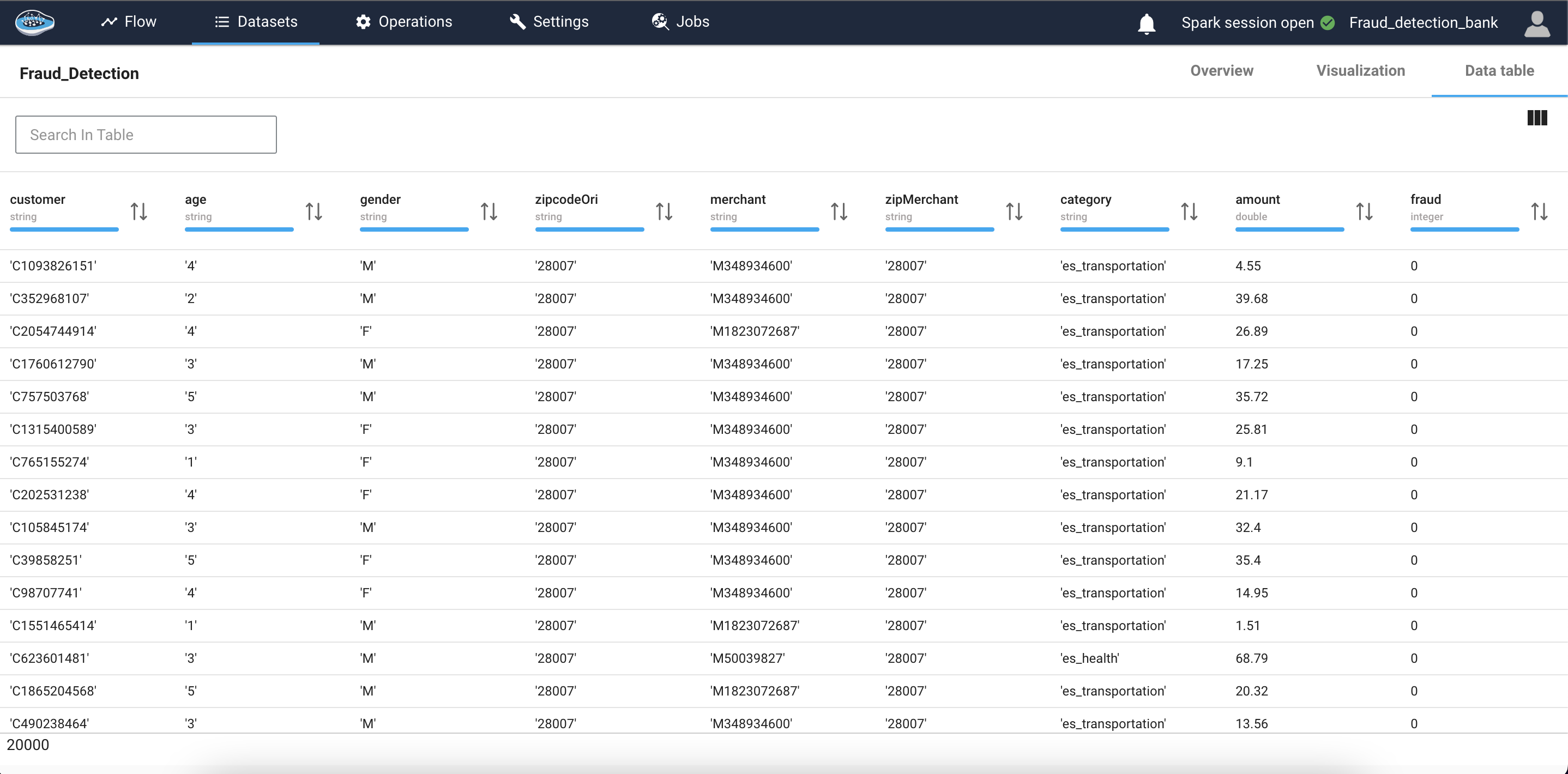

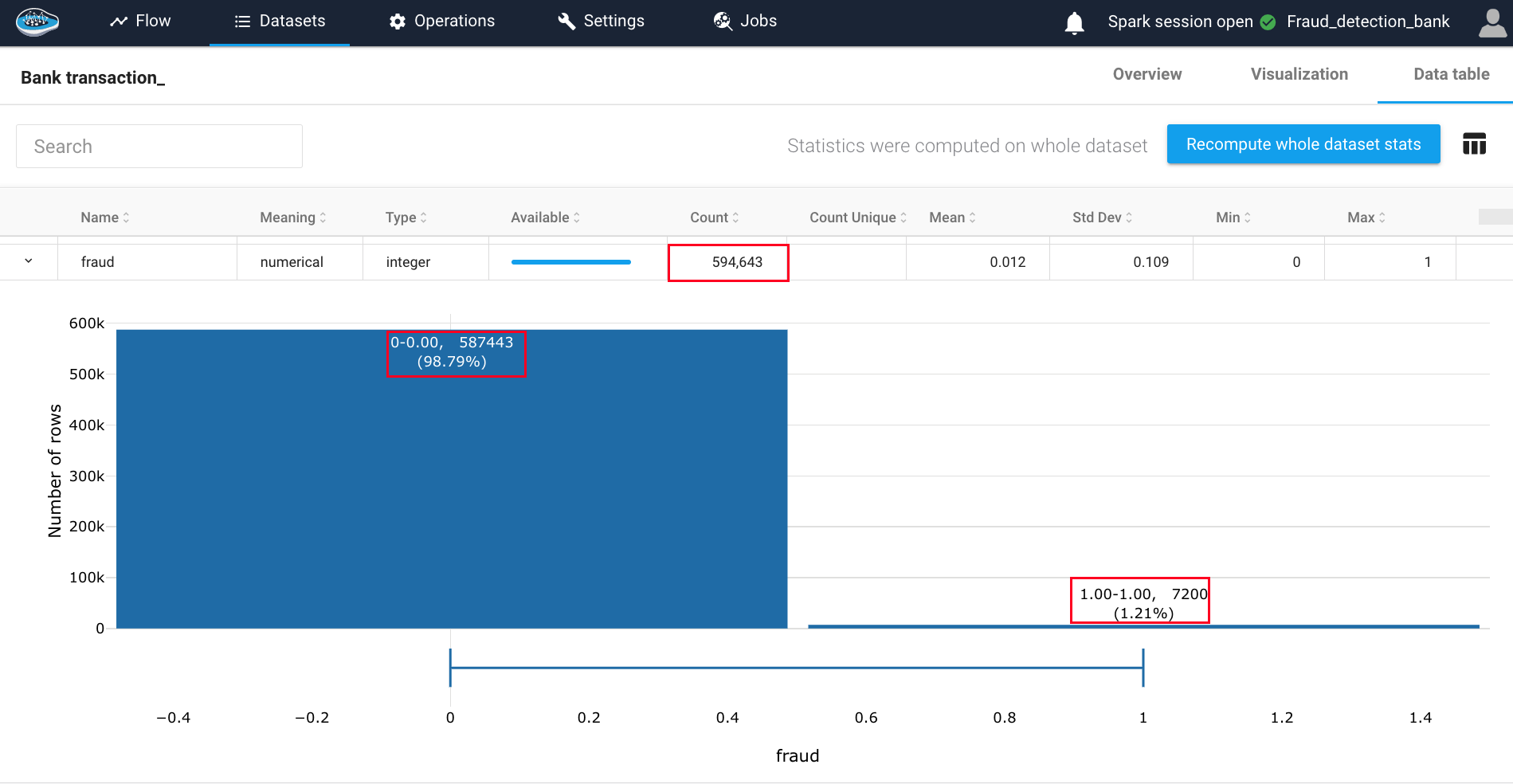

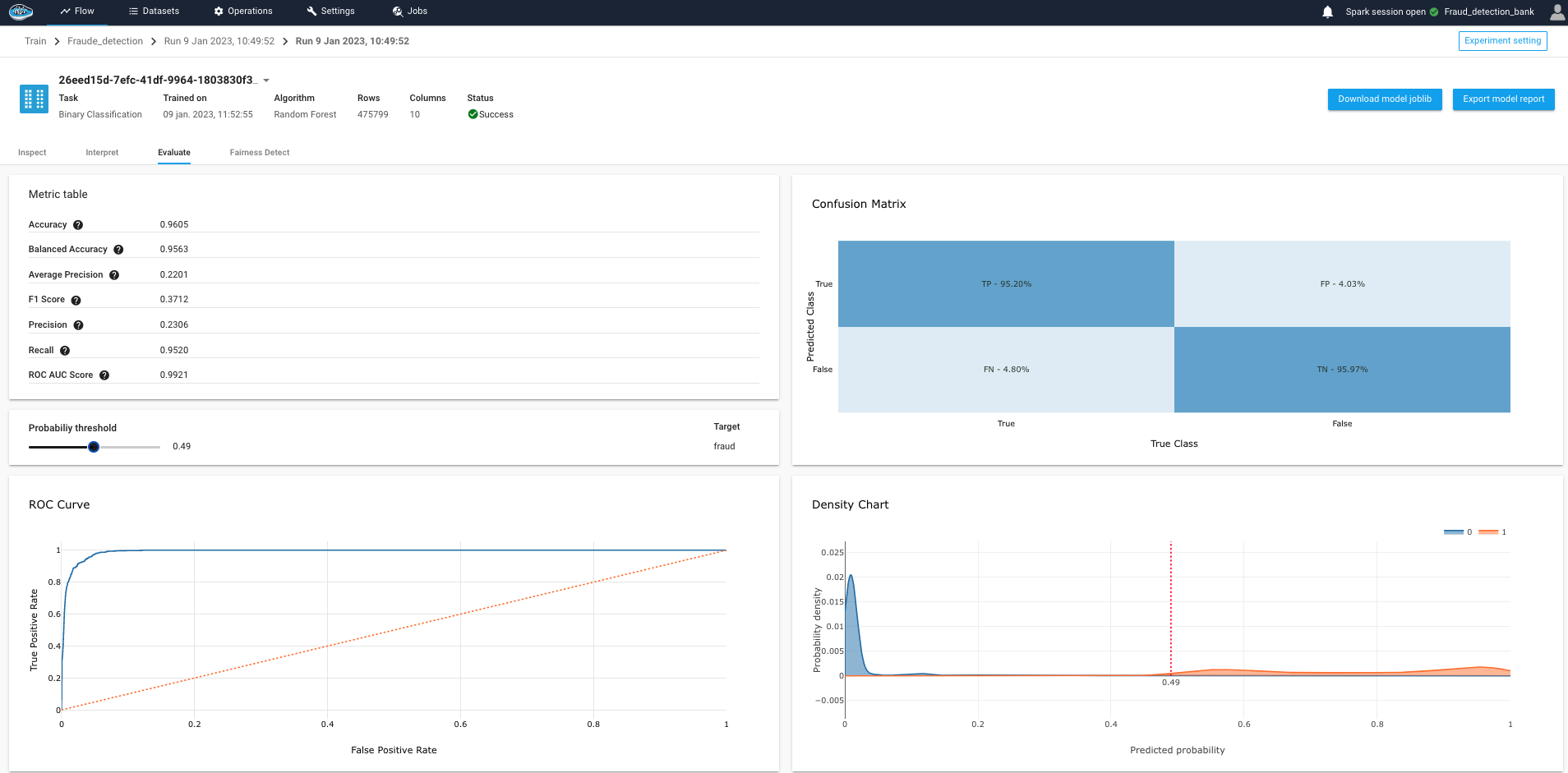

Fraud Detection

papAI analyzes customer behavior and transaction patterns over time to identify deviations from normal behavior, flagging suspicious activities that may indicate fraud.

papAI employs adaptive learning algorithms that continuously update and refine fraud detection models based on new data and emerging fraud patterns, ensuring ongoing effectiveness and adaptability to evolving threats.

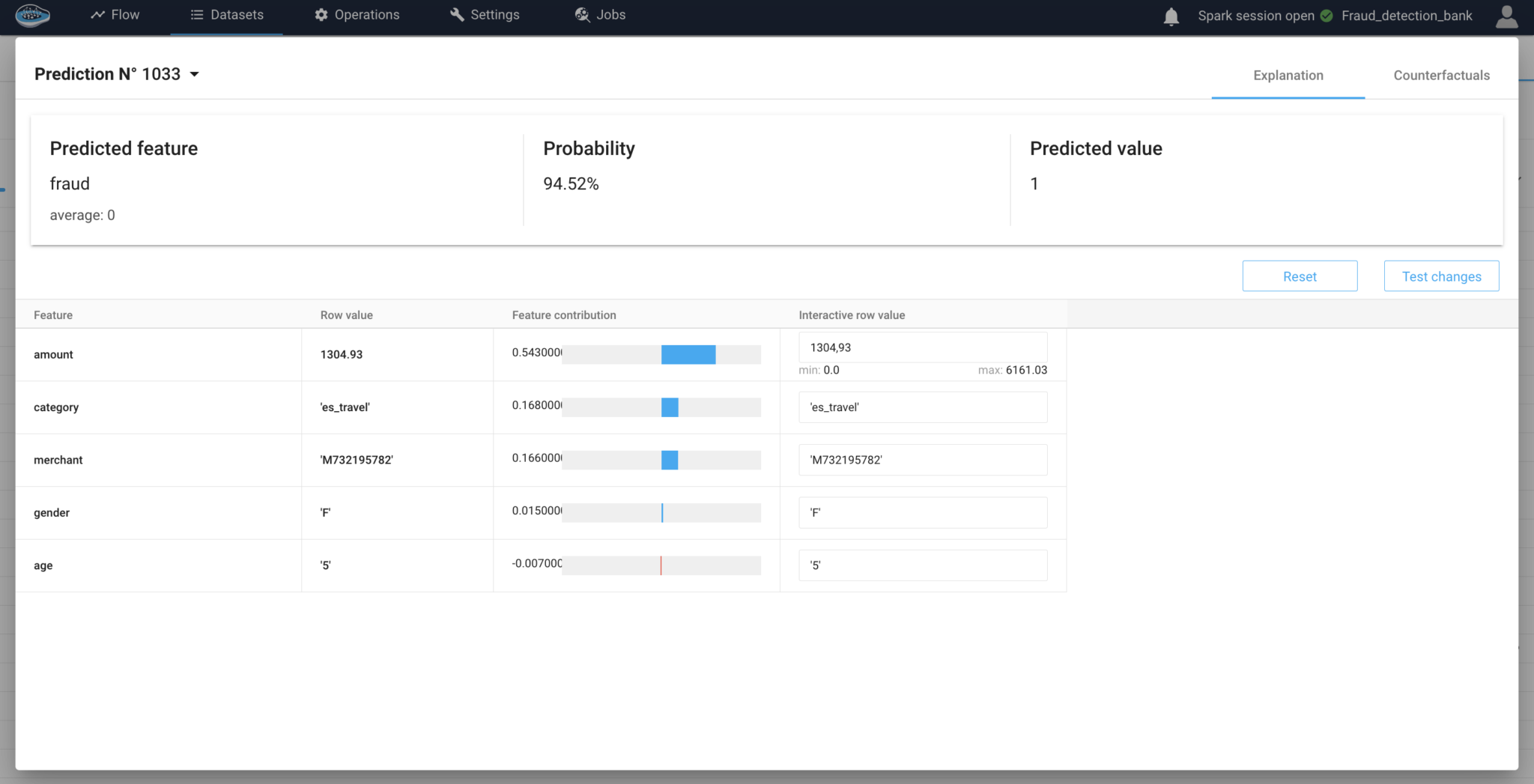

papAI performs feature importance analysis using techniques such as permutation importance or SHAP (SHapley Additive exPlanations) values to identify the most influential features for fraud detection and prioritize feature selection and engineering efforts.

Customer Segmentation Optimization

papAI conducts clustering analysis to group customers with similar characteristics or behaviors into distinct segments, allowing businesses to identify and target specific customer segments with tailored sales strategies.

papAI uses predictive analytics to anticipate future behaviors and preferences of customers within each segment, enabling businesses to personalize their sales efforts and anticipate customer needs.

papAI continuously updates customer segments based on real-time data and changes in customer behavior, ensuring that segmentation remains relevant and actionable.

Import relational databases (postgreSQL, mySQL, Oracle, MicrosoftSQL), upload CVS and Excel files, and insert APIs from a custom Python script.

The AI platform’s agile ETL will speed up massive data transfers to enhance your productivity outputs. The calculation engines are distributed without any configuration on your part.

Create your own analyses and choose from the different vizualization models offered (Statistics, Histograms of numerical and categorical data…). You can also view 2D, 3D and geographical plots.

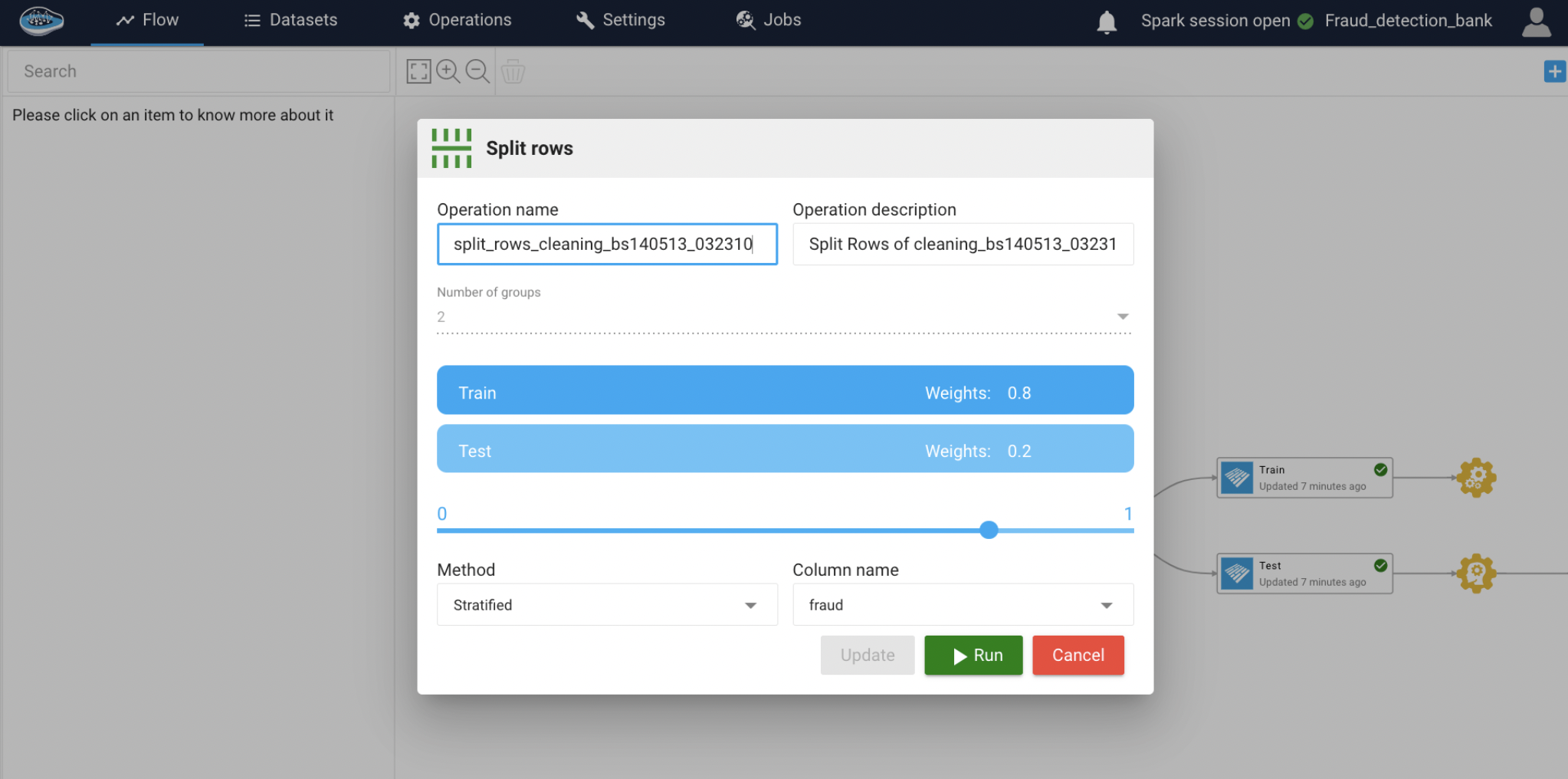

In papAI, powerful Machine Learning engineering will enable you to swiftly and easily deploy your predictive models throughout your pipelines: Feature Selection, Element Coding & Scaling, and Data Separation.

papAI offers a high degree of explicability of results thanks to its counter factual and feature impact functionality.

Accelerate from Data Collection to AI-Driven Decisions Swiftly

-

Real-time Data Processing

papAI can handle vast volumes of customer data in real-time, ensuring that insurance companies can make timely decisions based on the most up-to-date information.

-

Customizable AI Models

papAI allows insurance companies to tailor AI models to their specific needs. Whether it's churn prediction, or fraud detection, Insurance can create models that align with their unique business goals and requirements.

-

Explainable AI (XAI)

papAI provides transparent and interpretable AI models, allowing insurance companies to understand the reasoning behind AI-driven decisions. This feature is essential for compliance, regulatory reporting, and building trust with stakeholders.

-

Scalability

papAI is designed to scale with the evolving needs of insurance. Whether small or large, papAI can grow alongside the organization, ensuring that AI capabilities remain efficient and effective.

Step-by-Step AI Implementation: The Path to Enhanced Efficiency

How do we ensure our client's success?

Discover Our Use Cases

Explore our extensive range of use cases to see how papAI can address your specific needs and drive success in your organization.

Stay Ahead of Fraud - Sign Up for a Demo Today

AI-powered churn prediction systems have been shown to reduce churn costs by up to 80%.

Book your demo now to see papAI in action.