-

Optimizing Marketing Strategies with Real-World AppSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on91%85%Accuracy on

Optimizing Marketing Strategies with Real-World AppSCHEDULE LIVE DEMOpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on91%85%Accuracy on from data collection & cleansing to the seamless deployment of advanced machine learning models80%Personalized80%Optimizationfor Sentiment AnalysisCustomer LifetimeAccuracy onCustomerRecommendationsSegmentationValue Prediction

from data collection & cleansing to the seamless deployment of advanced machine learning models80%Personalized80%Optimizationfor Sentiment AnalysisCustomer LifetimeAccuracy onCustomerRecommendationsSegmentationValue Prediction

The AI Platform Built for Marketing Experts

Customer Lifetime Value Prediction

papAI seamlessly integrates with various data sources such as CRM systems, transactional databases, and marketing platforms to aggregate relevant customer data.

papAI utilizes advanced predictive analytics models to analyze historical customer data and identify patterns, trends, and behavior that are indicative of future purchasing behavior.

papAI dynamically scores and updates customer lifetime value predictions in real-time as new data becomes available, ensuring that predictions remain accurate and up-to-date.

Personalized Recommendations

papAI conducts in-depth behavioral analysis to understand individual customer preferences, habits, and interests, allowing for the creation of personalized recommendations tailored to each customer’s unique tastes.

papAI continuously learns and adapts to changes in customer behavior and market trends in real-time, ensuring that recommendations remain relevant and up-to-date.

papAI enables A/B testing of different recommendation algorithms and strategies to identify the most effective approaches for driving engagement and conversion, optimizing the recommendation engine over time.

Optimization Sentiment Analysis

papAI utilizes advanced NLP techniques to analyze text data from various sources, including social media, customer reviews, and surveys, to understand the sentiment expressed in the text.

papAI employs sentiment classification algorithms to automatically categorize text data into positive, negative, or neutral sentiments, enabling businesses to gauge public opinion and sentiment towards their products, services, or brand.

papAI provides visualization tools and dashboards that allow businesses to visually explore and analyze sentiment trends over time, helping them make informed decisions and take proactive measures to address any negative sentiment or feedback.

Customer Segmentation Optimization

papAI conducts clustering analysis to group customers with similar characteristics or behaviors into distinct segments, allowing businesses to identify and target specific customer segments with tailored marketing strategies.

papAI uses predictive analytics to anticipate future behaviors and preferences of customers within each segment, enabling businesses to personalize their marketing efforts and anticipate customer needs.

papAI continuously updates customer segments based on real-time data and changes in customer behavior, ensuring that segmentation remains relevant and actionable.

Import relational databases (postgreSQL, mySQL, Oracle, MicrosoftSQL), upload CVS and Excel files, and insert APIs from a custom Python script.

The AI platform’s agile ETL will speed up massive data transfers to enhance your productivity outputs. The calculation engines are distributed without any configuration on your part.

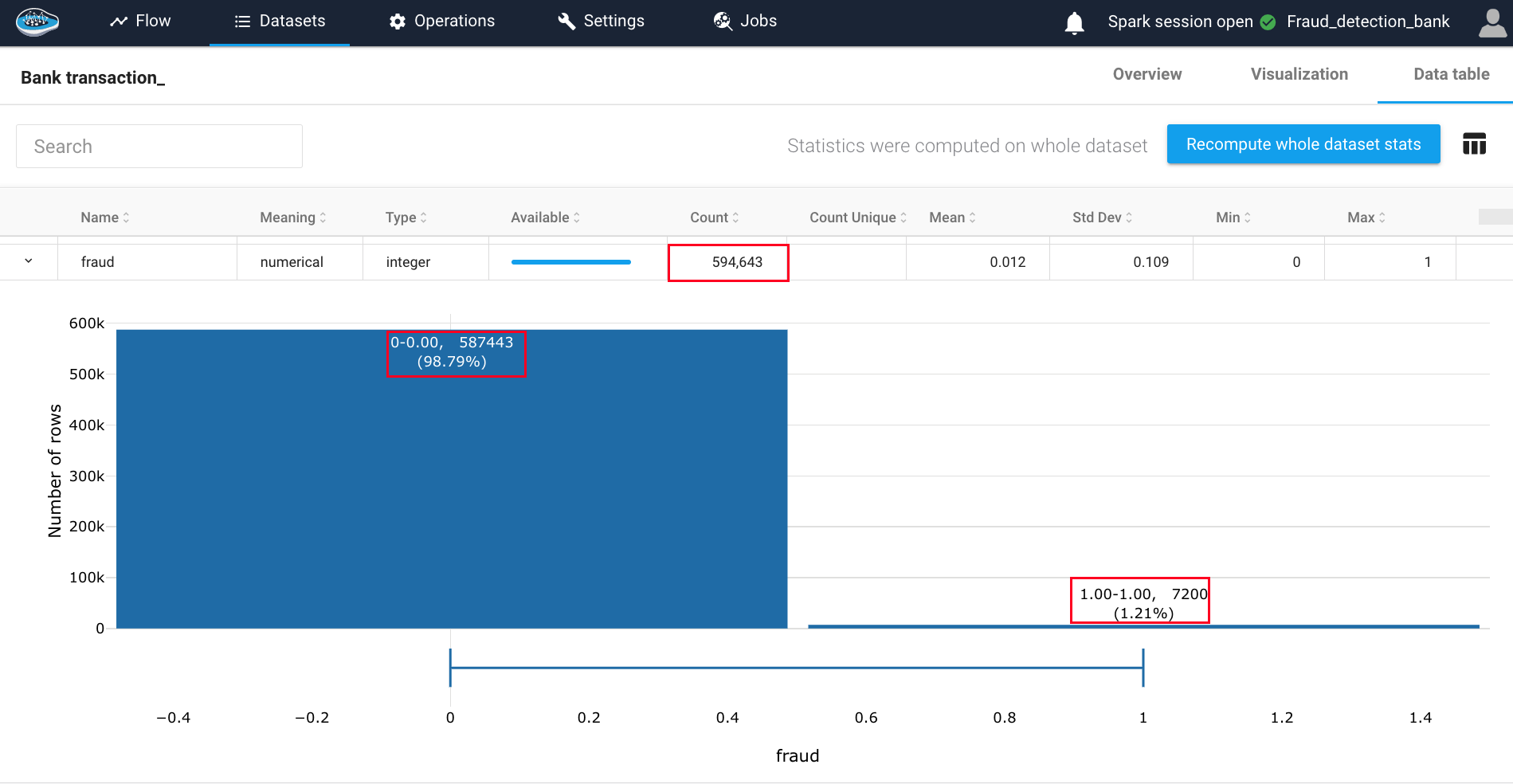

Create your own analyses and choose from the different vizualization models offered (Statistics, Histograms of numerical and categorical data…). You can also view 2D, 3D and geographical plots.

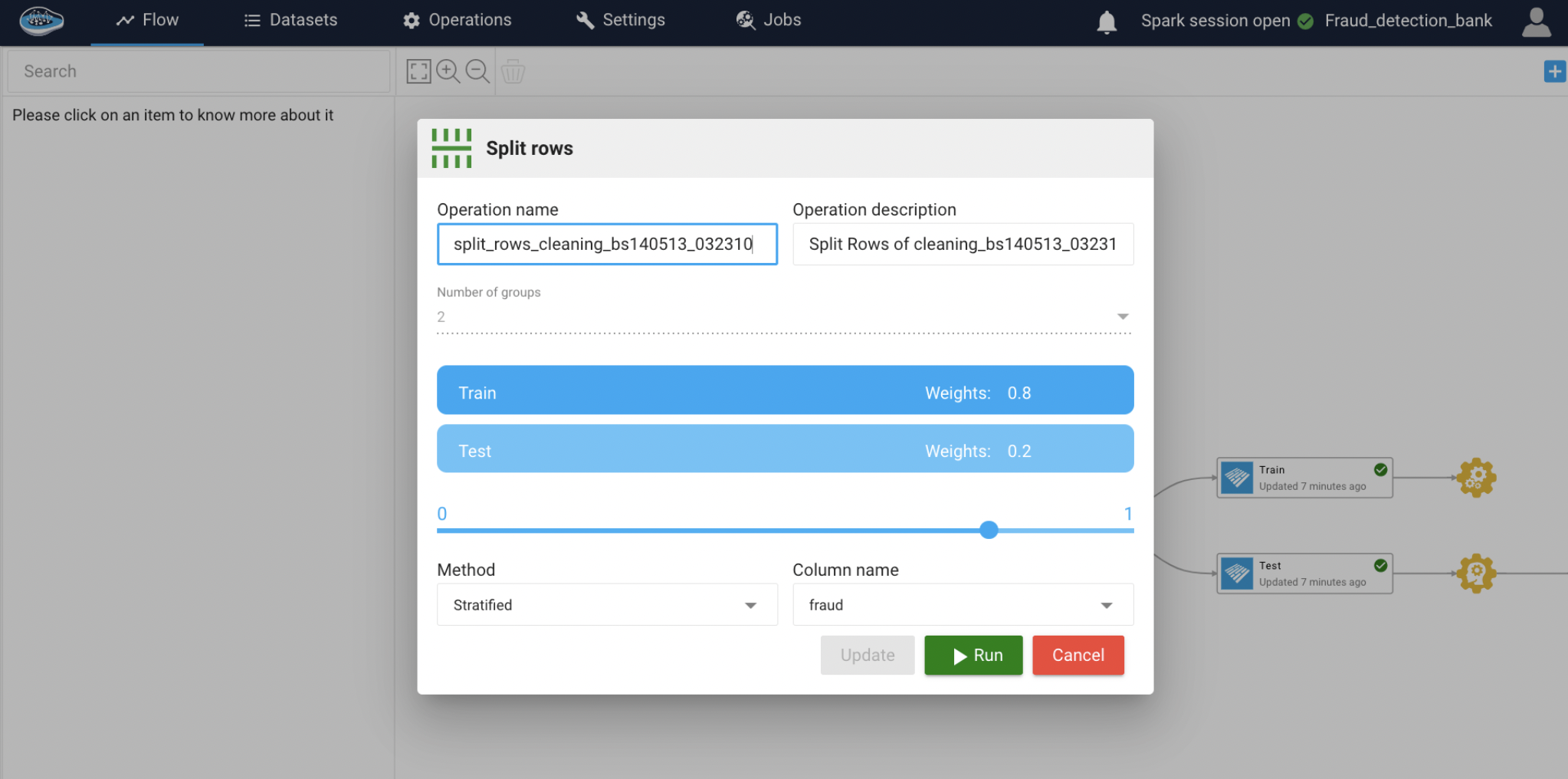

In papAI, powerful Machine Learning engineering will enable you to swiftly and easily deploy your predictive models throughout your pipelines: Feature Selection, Element Coding & Scaling, and Data Separation.

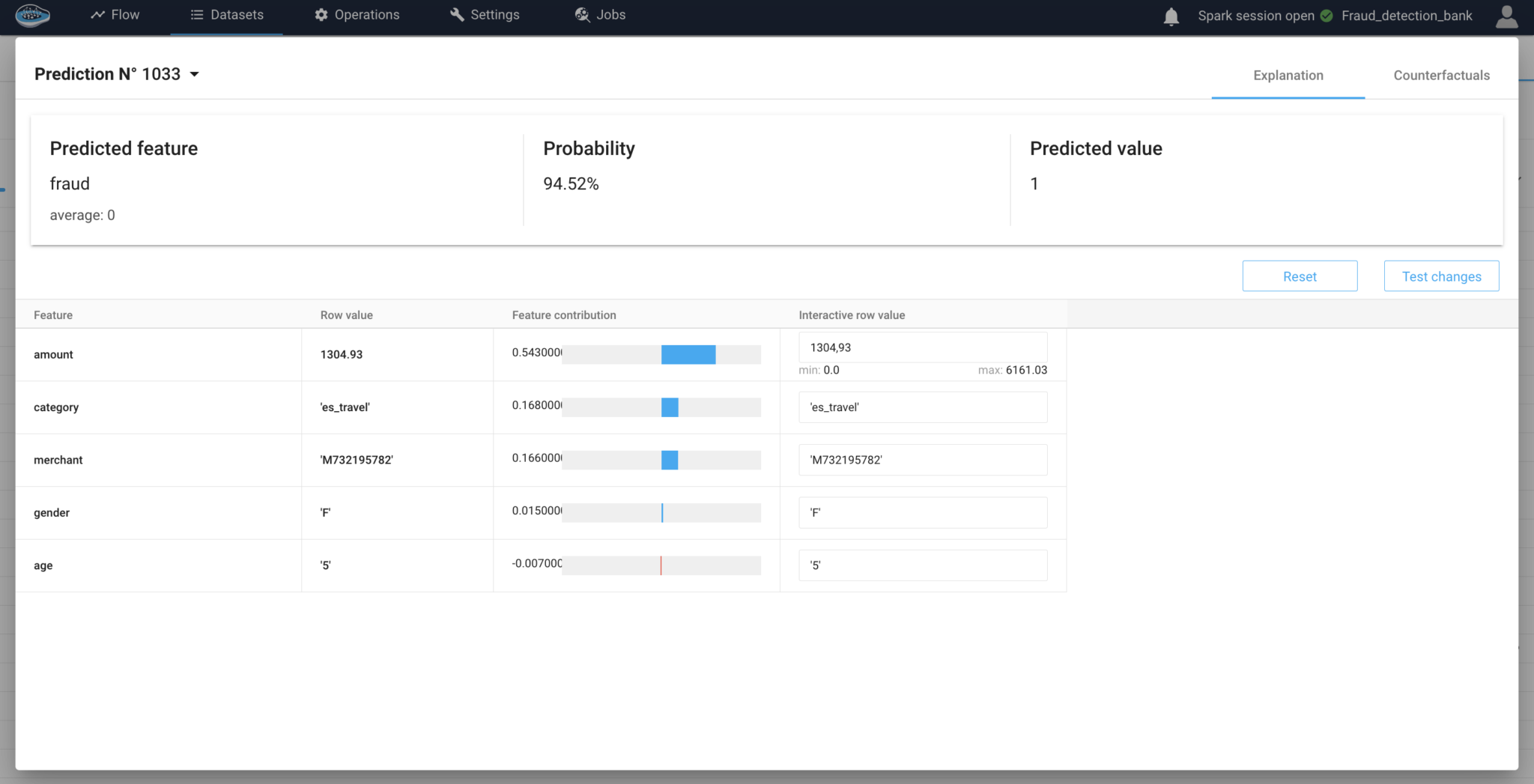

papAI offers a high degree of explicability of results thanks to its counter factual and feature impact functionality.

Accelerate from Data Collection to AI-Driven Decisions Swiftly

-

Real-time Data Processing

papAI can handle vast volumes of customer data in real-time, ensuring that insurance companies can make timely decisions based on the most up-to-date information.

-

Customizable AI Models

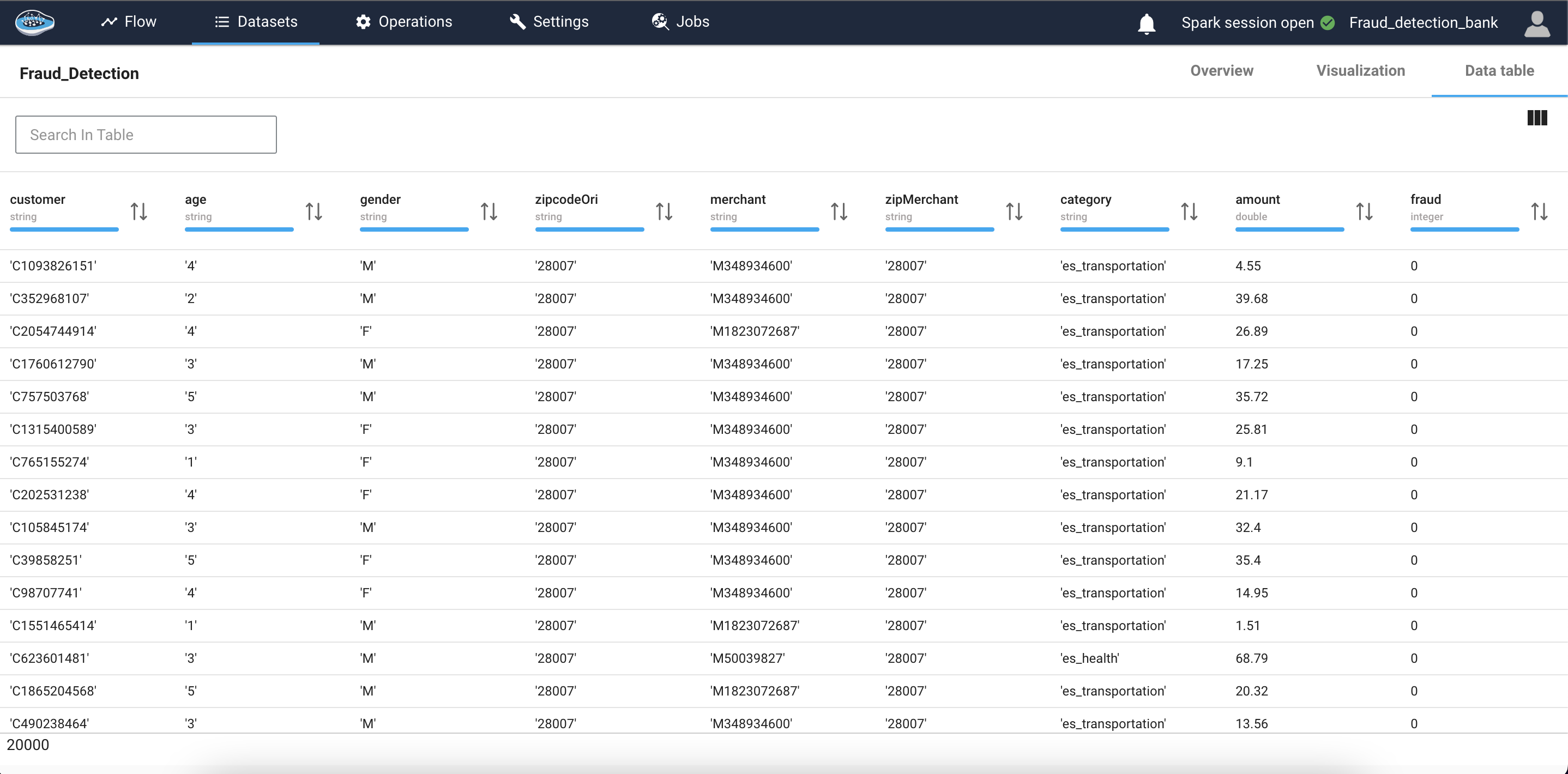

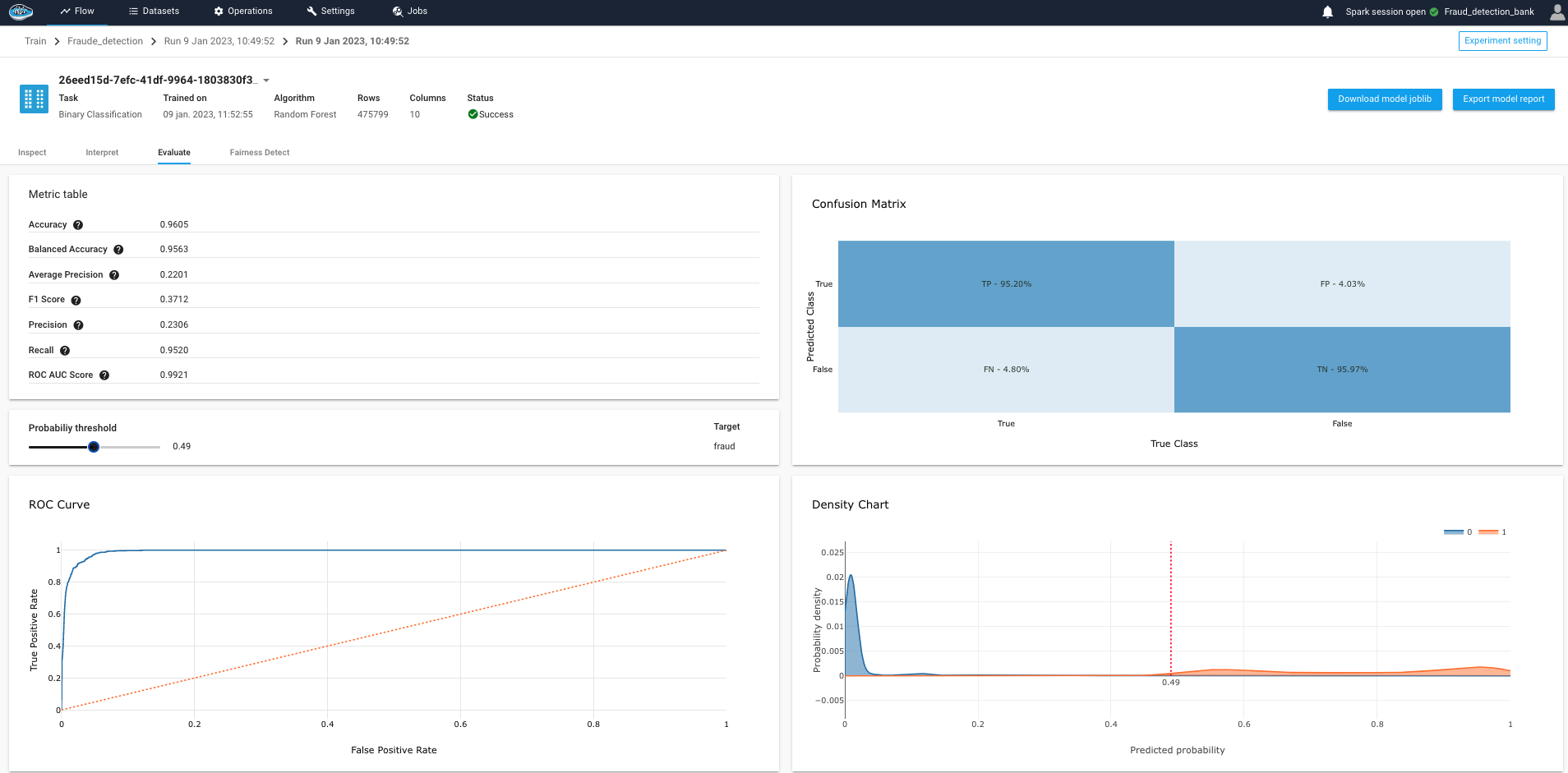

papAI allows insurance companies to tailor AI models to their specific needs. Whether it's churn prediction, or fraud detection, Insurance can create models that align with their unique business goals and requirements.

-

Explainable AI (XAI)

papAI provides transparent and interpretable AI models, allowing insurance companies to understand the reasoning behind AI-driven decisions. This feature is essential for compliance, regulatory reporting, and building trust with stakeholders.

-

Scalability

papAI is designed to scale with the evolving needs of insurance. Whether small or large, papAI can grow alongside the organization, ensuring that AI capabilities remain efficient and effective.

Step-by-Step AI Implementation: The Path to Enhanced Efficiency

How do we ensure our client's success?

Discover Our Use Cases

Explore our extensive range of use cases to see how papAI can address your specific needs and drive success in your organization.

Stay Ahead of Fraud - Sign Up for a Demo Today

AI-powered churn prediction systems have been shown to reduce churn costs by up to 80%.

Book your demo now to see papAI in action.