-

Your All-in-One AI Platform for BanksStart Free TrialpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%93%Accuracy on

Your All-in-One AI Platform for BanksStart Free TrialpapAI offers a comprehensive, end-to-end platform that masterfully covers the entire spectrumAccuracy on95%93%Accuracy on from data collection & cleansing to the seamless deployment of advanced machine learning models80%Fraud Detection90%Accuracy onWeak Signal DetectionChurn PredictionDecrease inAI Deployment TIme

from data collection & cleansing to the seamless deployment of advanced machine learning models80%Fraud Detection90%Accuracy onWeak Signal DetectionChurn PredictionDecrease inAI Deployment TIme

Banks Double Down on Investment in Artificial Intelligence (Gartner)

The adoption of AI is poised to reshape the banking sector by enhancing operational efficiency, improving customer experiences, and enabling data-driven decision-making. With this substantial surge in investment, financial institutions are positioning themselves to lead the charge into the AI-driven future of banking, where innovation and customer-centric solutions will be at the forefront.

The AI Platform Built for Your Industry

Customer Churn Prediction

papAI allows banks to segment their customer base based on various attributes like demographics, transaction history, and customer preferences. This segmentation enables personalized retention strategies for different customer groups.

The platform employs predictive analytics to forecast potential churn by analyzing various factors such as customer engagement, complaints, and account activities. Banks can leverage these predictions to intervene before customers decide to leave.

papAI generates automated action plans based on churn predictions. These plans include recommended actions and strategies to retain at-risk customers

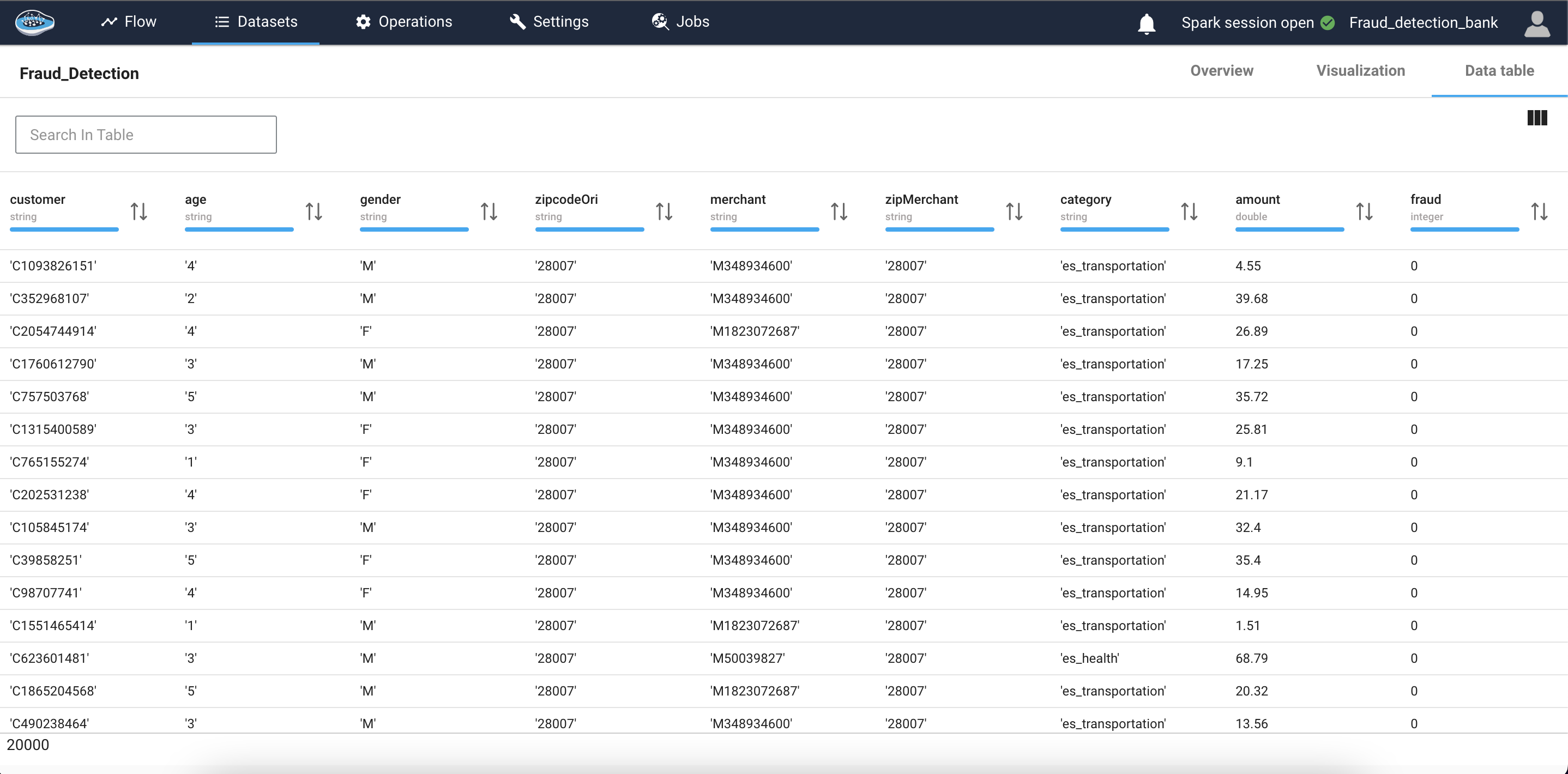

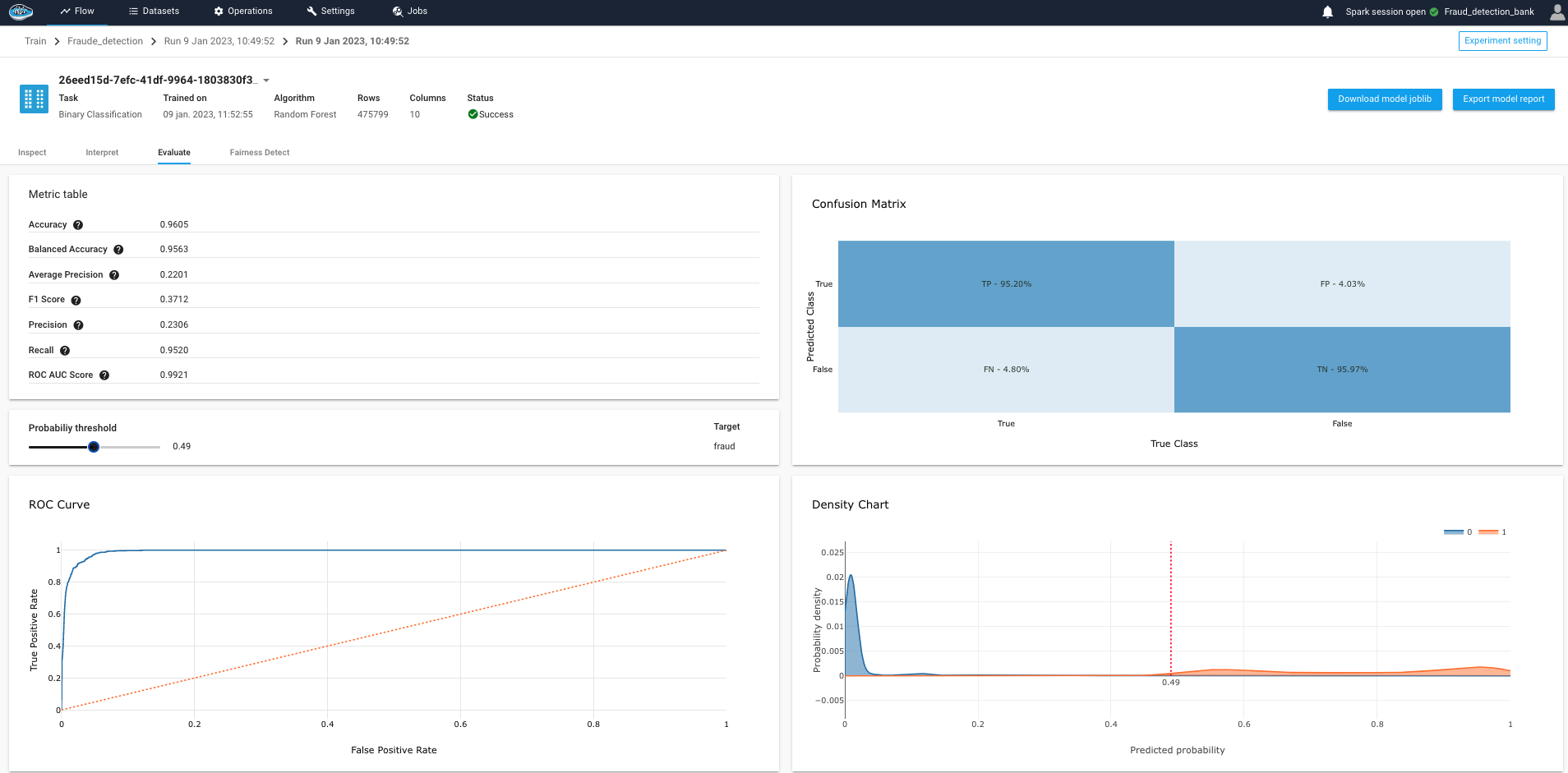

Fraud detection

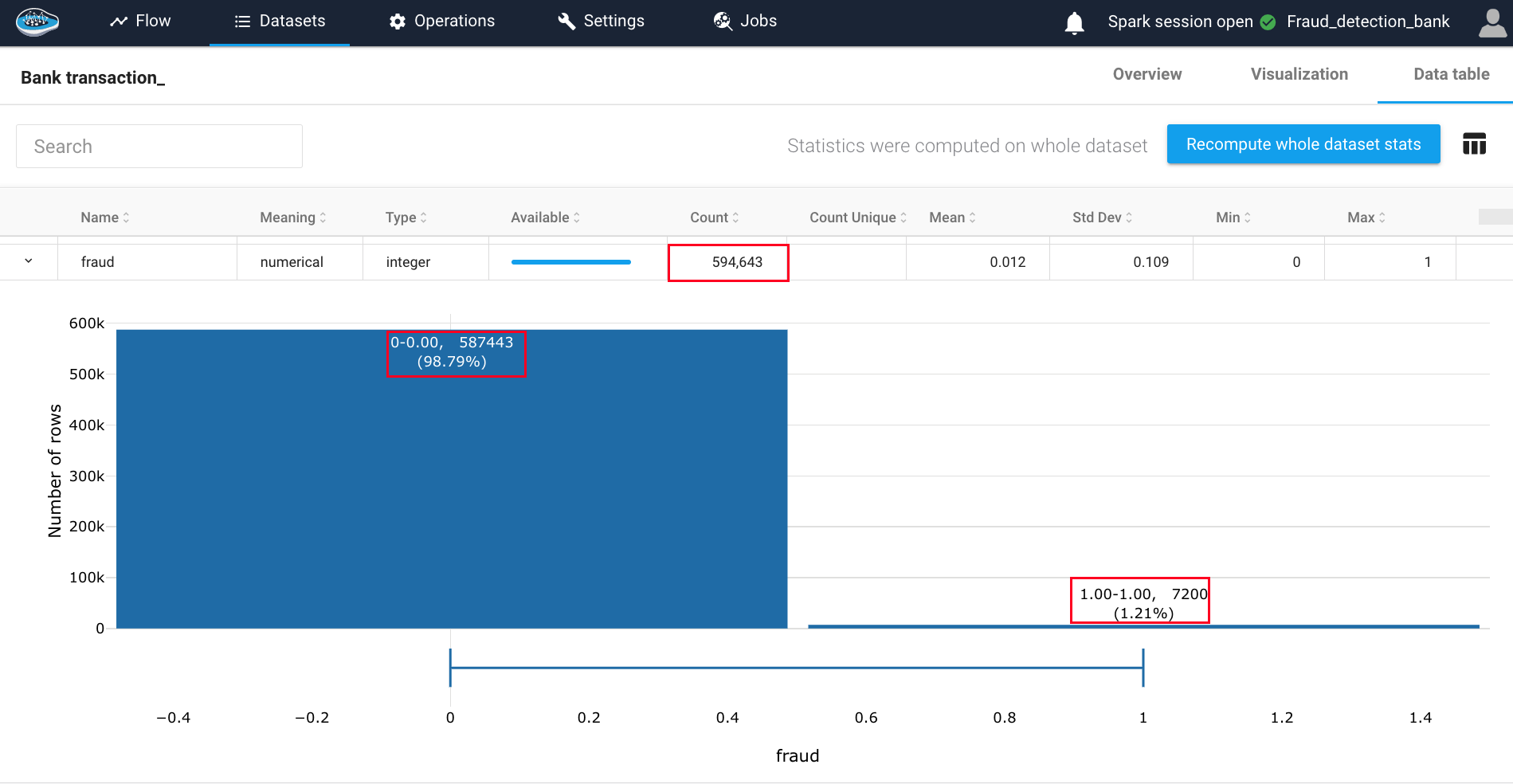

papAI is equipped with advanced anomaly detection algorithms that continuously monitor transaction data. It can identify unusual patterns, irregular transactions, and suspicious activities in real-time.

The platform performs in-depth behavior analysis of customers, studying their transaction history, location patterns, and typical spending habits. It can recognize deviations from established customer behavior and raise alerts when it identifies actions that could indicate fraudulent activities.

papAI leverages predictive analytics to forecast potential fraud incidents based on historical data and emerging trends. It provides banks with early warnings and alerts, allowing them to take proactive measures to prevent fraud before it happen.

Credit Scoring

papAI offers a wide range of advanced machine learning models designed to assess an individual’s creditworthiness comprehensively. These models analyze various factors such as credit history, income, debt, and more to generate precise credit scores, helping banks make informed lending decisions.

papAI can provide real-time credit assessments, allowing banks to respond quickly to loan applications. It enables banks to automate the credit evaluation process and assess a borrower’s risk profile instantly, resulting in faster loan approvals and a seamless customer experience.

papAI allows banks to tailor credit scoring criteria to their specific needs. It enables banks to define custom credit risk factors and weight them according to their lending policies, ensuring that the credit scoring process aligns with the bank’s unique requirements and business goals.

Weak Signal Detection

apAI employs sophisticated signal processing techniques to detect subtle anomalies or patterns within a vast amount of financial data. It can uncover hidden signals or outliers that may indicate unusual or fraudulent activities, enhancing banks’ ability to identify potential threats promptly.

papAI allows banks to set up customizable alerting systems based on the detected weak signals. This feature enables banks to define specific thresholds and criteria for triggering alerts, ensuring that relevant information reaches the right teams or individuals within the organization in a timely manner.

papAI’s machine learning capabilities ensure that its weak signal detection algorithms evolve over time. As it encounters new data and emerging trends, the system continuously adapts to improve its accuracy in identifying weak signals, helping banks stay ahead of potential risks and opportunities in the financial market.

Import relational databases (postgreSQL, mySQL, Oracle, MicrosoftSQL), upload CVS and Excel files, and insert APIs from a custom Python script.

The AI platform’s agile ETL will speed up massive data transfers to enhance your productivity outputs. The calculation engines are distributed without any configuration on your part.

Create your own analyses and choose from the different vizualization models offered (Statistics, Histograms of numerical and categorical data…). You can also view 2D, 3D and geographical plots.

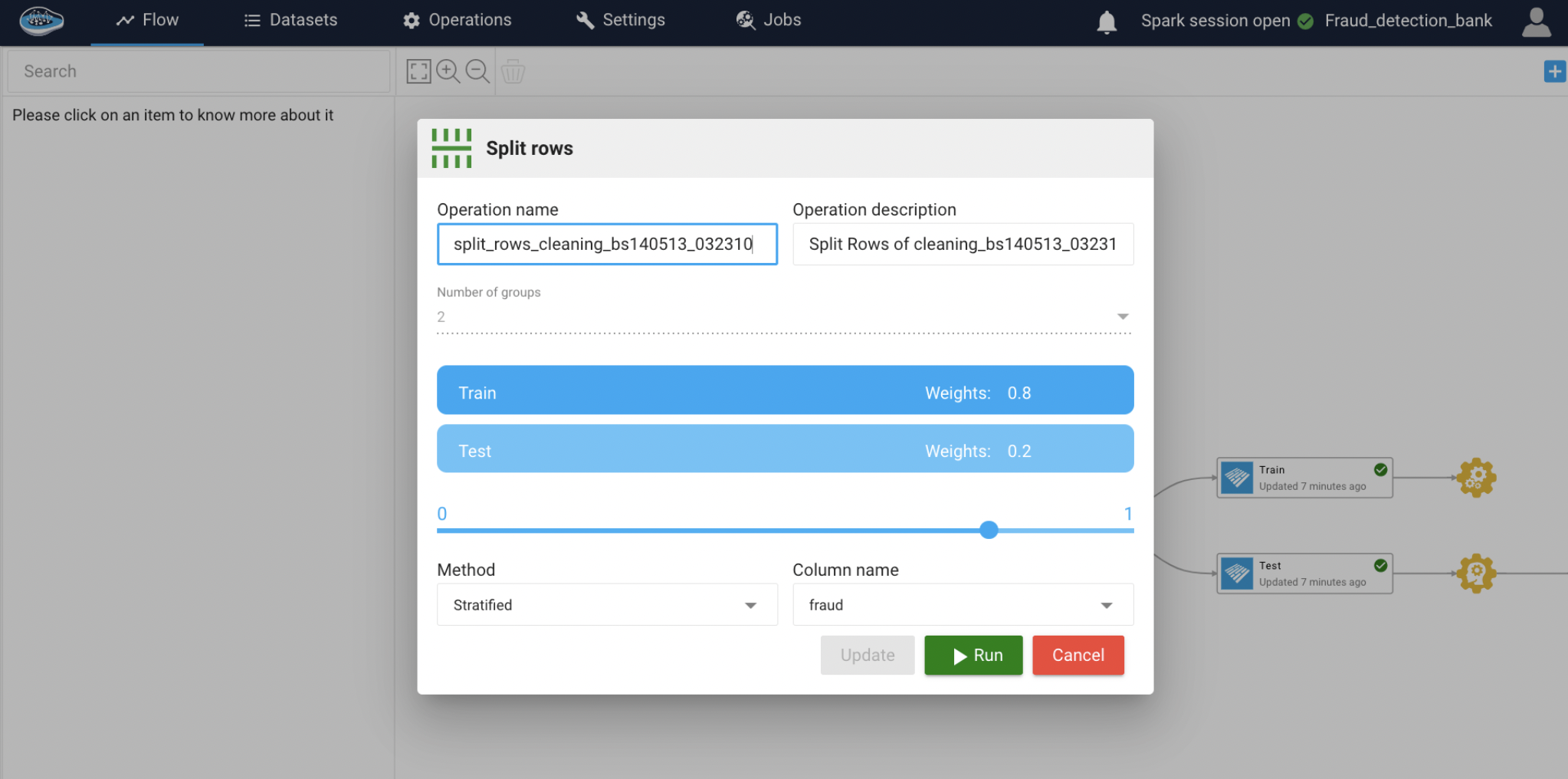

In papAI, powerful Machine Learning engineering will enable you to swiftly and easily deploy your predictive models throughout your pipelines: Feature Selection, Element Coding & Scaling, and Data Separation.

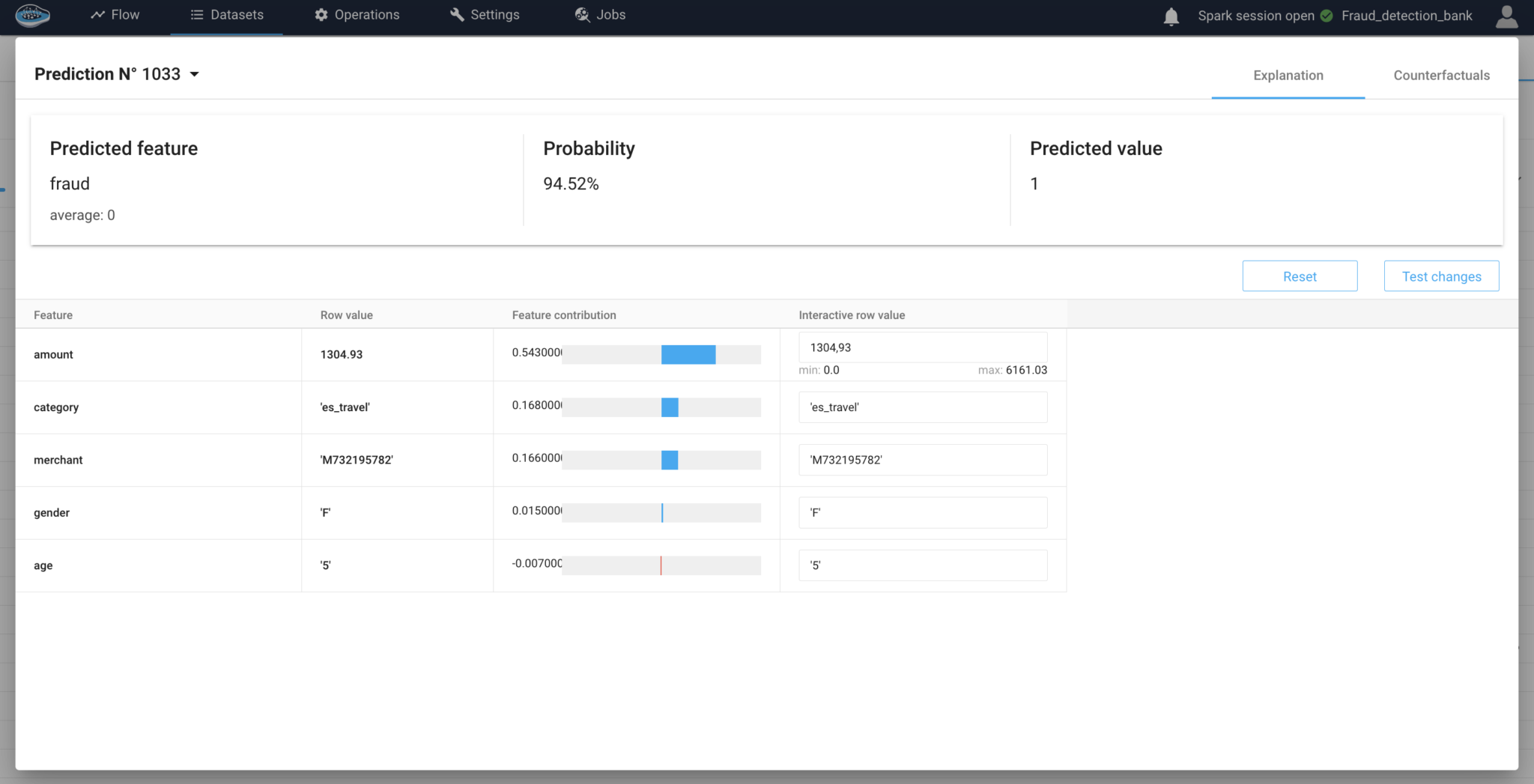

papAI offers a high degree of explicability of results thanks to its counter factual and feature impact functionality.

Accelerate from Data Collection to AI-Driven Decisions Swiftly

-

Real-time Data Processing

papAI can handle vast volumes of financial data in real-time, ensuring that banks can make timely decisions based on the most up-to-date information.

-

Customizable AI Models

papAI allows banks to tailor AI models to their specific needs. Whether it's churn prediction, fraud detection, credit scoring, or other tasks, banks can create models that align with their unique business goals and requirements.

-

Explainable AI (XAI)

papAI provides transparent and interpretable AI models, allowing banks to understand the reasoning behind AI-driven decisions. This feature is essential for compliance, regulatory reporting, and building trust with stakeholders.

-

Scalability

papAI is designed to scale with the evolving needs of banks. Whether a bank is small or large, papAI can grow alongside the organization, ensuring that AI capabilities remain efficient and effective.

AI Implementation with Stepwise Approach to Efficiency

How do we ensure our client's success?

Discover Our Use Cases

Explore our extensive range of use cases to see how papAI can address your specific needs and drive success in your organization.

Stay Ahead of Fraud - Sign Up for a Demo Today

AI-powered churn prediction systems have been shown to reduce churn costs by up to 80%.

Book your demo now to see papAI in action.