We Don’t Just Build AI, We Deliver Measurable Impact Join...

Read MoreOptimizing Credit Card Eligibility with AI

Table of Contents

ToggleIn many countries, obtaining a credit card is a complex process governed by numerous parameters and rules. Traditionally, this involved a labor-intensive method where a large team of people would collect and analyze vast amounts of unstructured information manually. Today, AI has revolutionized this process. With the power of AI, vast datasets can be analyzed quickly and accurately, streamlining the credit card eligibility assessment and making it more efficient than ever before.

Implementing AI optimization strategies has resulted in a 15% uplift in monthly card spending by customers selected for credit line increases without increasing bad debt. (Source: HSBC)

Find out how papAI can improve the deployment of AI projects in the Banking Sector here.

In this article, we will discover how AI optimizes credit card eligibility, enhancing accuracy and efficiency in approval processes for better financial inclusion and customer satisfaction.

Financial Services: The Use of AI

The financial services sector is undergoing a transformation thanks to artificial intelligence (AI), which improves customer satisfaction, accuracy, and efficiency. AI provides unmatched capabilities in data processing and analysis in an industry where enormous volumes of data are generated every day. Compared to earlier techniques, financial institutions can now sort through enormous datasets, spot trends, and come to well-informed decisions much more quickly by utilizing machine learning algorithms.

AI is also essential for fraud detection and regulatory compliance. Financial institutions must comply with stringent regulations that necessitate ongoing oversight and documentation. By automating compliance checks and making sure all transactions follow legal requirements, artificial intelligence (AI) systems can lower the risk of non-compliance and the fines that come with it.

Artificial intelligence (AI) algorithms are capable of real-time analysis of transaction patterns in order to spot anomalies that might point to fraud. Artificial intelligence (AI) assists in preventing fraud before it can cause major harm, safeguarding the institution and its clients by promptly recognising and reporting suspicious transactions.

What are the Main AI Technologies for Credit Card Evaluation?

1. Machine learning: Credit card evaluation heavily relies on machine learning, a subset of artificial intelligence. Without explicit programming, machine learning algorithms gain improved over time by learning from past data. Machine learning (ML) models are used in credit card evaluation to forecast future creditworthiness by analysing past financial behaviours of applicants, including spending patterns, repayment histories, and credit utilisation.

How Operates:

Data collection: Compiling past information on earnings, work status, credit history, and spending patterns.

Training ML models with this data so they can find patterns and correlations later on is known as model training.

Prediction: Using the trained model to forecast whether new applicants will be responsible borrowers or likely to default.

2. Nature Language Processing (NLP): NLP enables artificial intelligence (AI) systems to comprehend and analyse natural language. Natural language processing (NLP) is used in credit card evaluation to examine unstructured data, including customer reviews, social media profiles, and other text-based material that can reveal details about an applicant’s credit history and dependability.

How Operates:

Text analysis is the process of gleaning important information from textual data, such as social media posts or customer support conversations.

Sentiment analysis: interpreting the tone of these texts to assess the candidate’s perspective on fiscal responsibility.

Risk assessment is the process of combining these insights with organised data to assess an applicant’s creditworthiness holistically.

3. Deep Learning: Deep Learning is a subfield of machine learning that models complex patterns in data by employing multilayered neural networks. Processing and analyzing high-dimensional data, such as transaction histories, spending patterns, and even photos or documents submitted by applicants, is especially helpful in credit card evaluation.

How Operates:

Deep neural networks are used to model intricate dependencies and relationships in data.

Feature extraction: To increase prediction accuracy, pertinent features are automatically extracted from raw data.

Scoring: Using the patterns found by the deep learning model, a credit score is generated.

What are the Benefits of Using AI for Credit Card Eligibility

- Enhanced Accuracy: By utilising its capacity to handle enormous volumes of data quickly, artificial intelligence considerably increases the accuracy of credit card eligibility determinations. Conventional techniques frequently depend on manual data analysis, which is laborious and prone to human error. Conversely, AI models exhibit remarkable accuracy in the analysis of large datasets, such as credit histories, spending patterns, and employment records. With this ability, AI can find correlations and patterns that human analysts might miss, which results in more precise evaluations of an applicant’s creditworthiness.

- Better Fraud Detection: By examining transaction patterns and spotting behavioral anomalies that might point to fraudulent activity, artificial intelligence (AI) improves fraud detection capabilities. Conventional approaches to detecting fraud frequently depend on rule-based systems, which may have a narrow scope and be sluggish to adjust to novel fraud strategies. AI continuously learns from new data and updates its models to detect even the most complex fraud schemes thanks to its machine learning algorithms. Financial institutions can keep one step ahead of fraudsters and better safeguard their assets with this proactive approach.

- Improved Hazard Handling: By offering more thorough and accurate evaluations of an applicant’s creditworthiness, artificial intelligence dramatically improves risk management. Conventional risk management techniques frequently rely on set rules and historical data, which can have a limited applicability and be sluggish to adjust to shifting conditions. Conversely, artificial intelligence (AI) employs sophisticated machine learning algorithms to instantly assess a range of risk factors, such as credit history, employment status, and financial behavior. As a result, risk assessments can be dynamic and current, better reflecting the financial circumstances of the applicant.

- Regulatory Compliance: AI automates reporting and compliance checks, assisting financial institutions in staying in compliance with regulations. Financial institutions are subject to strict and ever-changing regulatory requirements that mandate the monitoring and reporting of multiple facets of their operations. By automating these chores, artificial intelligence (AI) systems can conduct audits in real-time to make sure that all transactions and procedures follow legal requirements. Automation guarantees that compliance measures are implemented uniformly throughout the company and lessens the workload for compliance teams.

What are the Challenges and Considerations in AI Deployment in this field?

By addressing these challenges, organizations can deploy AI responsibly while maximizing its benefits in credit assessment. let’s explore some of that:

Concerns about Data Privacy and Ethics:

Large volumes of financial and personal data are needed for AI-driven credit evaluations to produce reliable forecasts. Because sensitive data like transaction history, income levels, and even social behaviours may be examined, this presents serious privacy issues. In order to prevent breaches or misuse, financial institutions must make sure they appropriately gather, store, and process data.

Transparency and data ownership are significant ethical dilemmas. Consumers might not always understand how their information is used to assess their creditworthiness. This lack of transparency, particularly when AI-driven judgments appear ambiguous or inexplicable, can breed mistrust and perhaps give rise to legal problems.

Making Sure Financial Regulations Are Followed:

AI used in credit assessment must adhere to stringent regulatory guidelines intended to safeguard customers and advance equity. Strict rules on data collection, processing, and decision-making transparency are enforced by laws like the Fair Credit Reporting Act (FCRA) in the United States and the General Data Protection Regulation (GDPR) in Europe.

Explainability, also known as the “black box” problem in AI, is one major obstacle. Due to their complexity, many machine learning models are difficult to understand and give concise justifications for their choices. Financial institutions must, however, make sure that their AI-powered credit evaluations continue to be comprehensible and adhere to laws that demand lending choices be transparent.

Banking industry : Lead your Business teams to embrace AI

The banking services industry has long been a leader in AI implementation, discover in this free White Paper the power of “Explainable Artificial Intelligence”.

Use Case: Leveraging papAI Solution to Enhance Credit Card Eligibility

Context

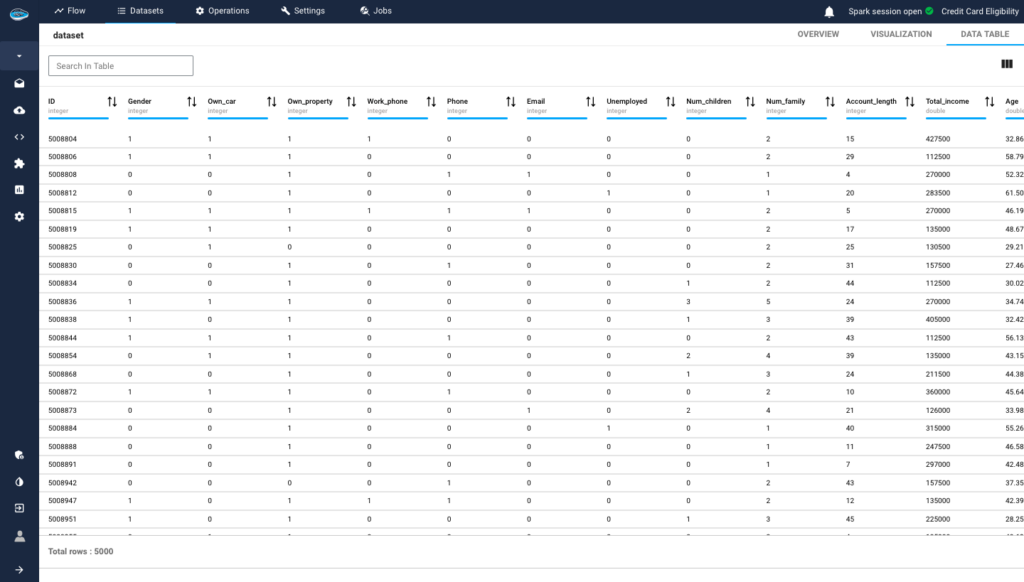

The dataset is a comprehensive collection of variables aimed at understanding the factors that influence an individual’s eligibility for a credit card. This dataset encompasses a wide range of demographic, financial, and personal attributes that are commonly considered by financial institutions when assessing an individual’s suitability for credit.

Each row in the dataset represents a unique individual, identified by a unique ID, with associated attributes ranging from basic demographic information such as gender and age, to financial indicators like total income and employment status. Additionally, the dataset includes variables related to familial status, housing, education, and occupation, providing a holistic view of the individual’s background and circumstances.

1- Data Exploration

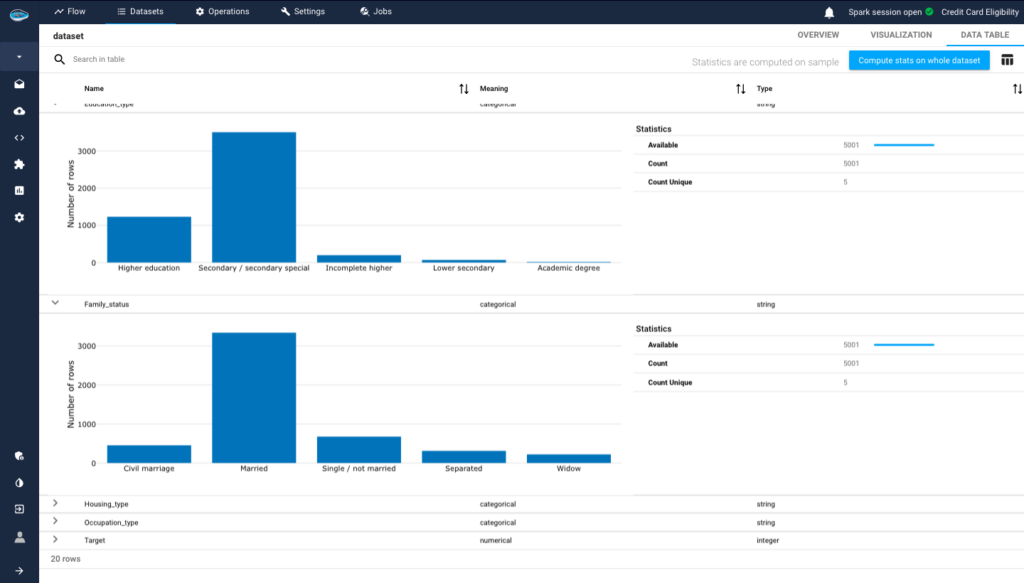

papAI offers automated statistical analysis, giving users a comprehensive overview of dataset characteristics. It computes a range of statistics for each variable. For categorical variables, it provides access to graphs that illustrate the distribution of each categorical variable and calculates metrics such as Count and Count Unique.

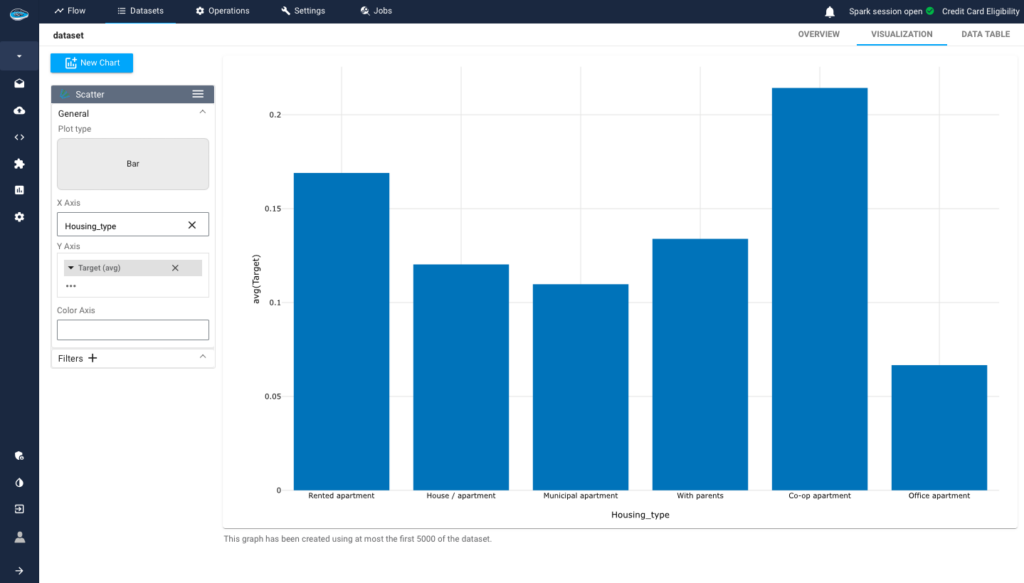

Analysis offers a comprehensive view of the data, facilitating more informed decisions and insights. By using papAI, we can visualize the data with charts such as a bar plot. Here for example, housing_type is on the x-axis and the credit card eligibility variable is on the y-axis, helping us to uncover meaningful patterns and insights.

2- Preprocessing Data :

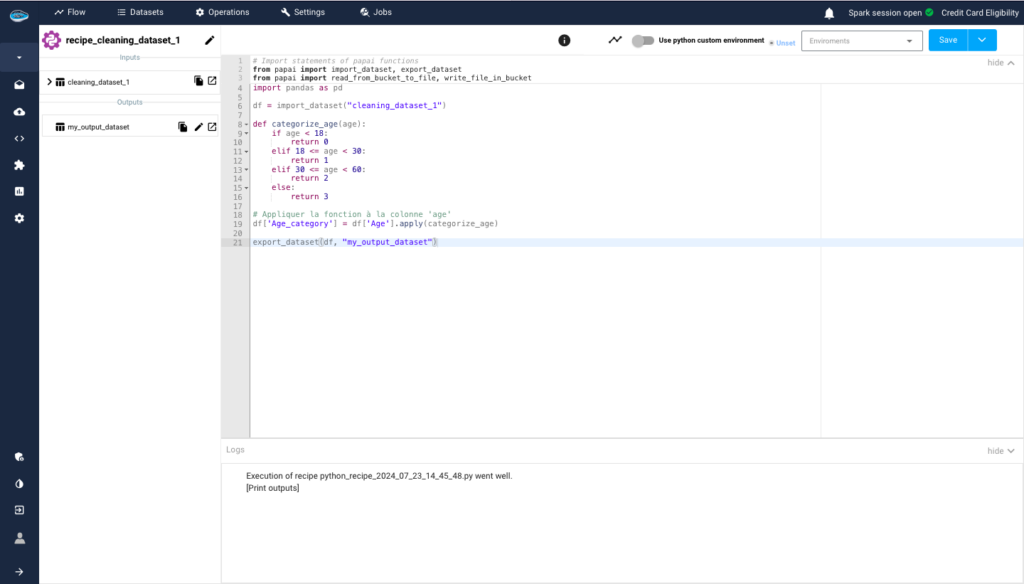

An essential step in the process is preprocessing, where we prepare and clean our dataset before building the model and making predictions. For instance, We used a Python script to categorize age groups in the dataset. With papAI, we can efficiently handle such preprocessing tasks and streamline the data preparation process.

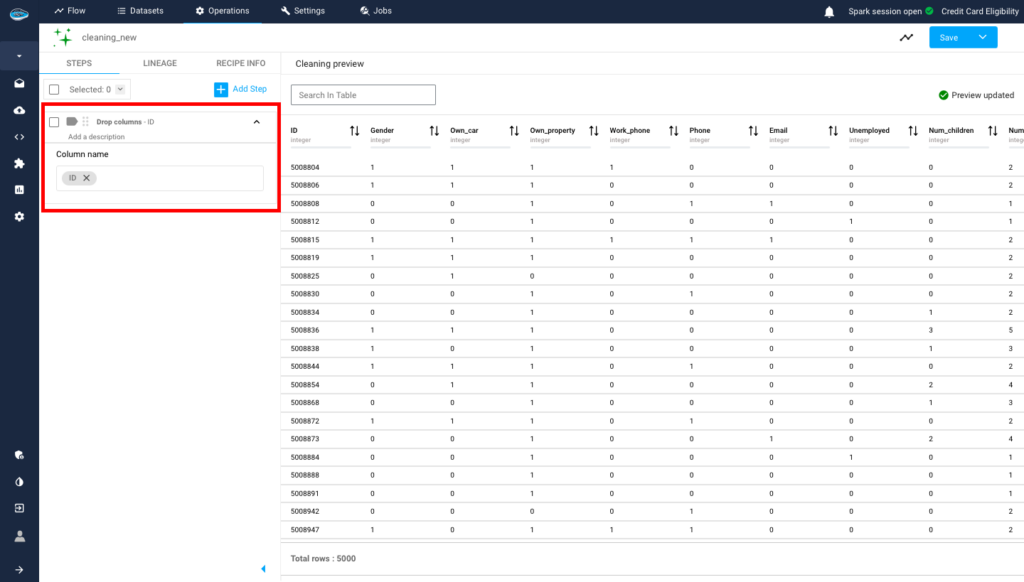

Another beneficial cleaning process includes eliminating the ID column, which mainly serves as an identifier and doesn’t significantly impact our analysis. This action aids in simplifying the dataset by concentrating on more pertinent characteristics.

3- Building Model :

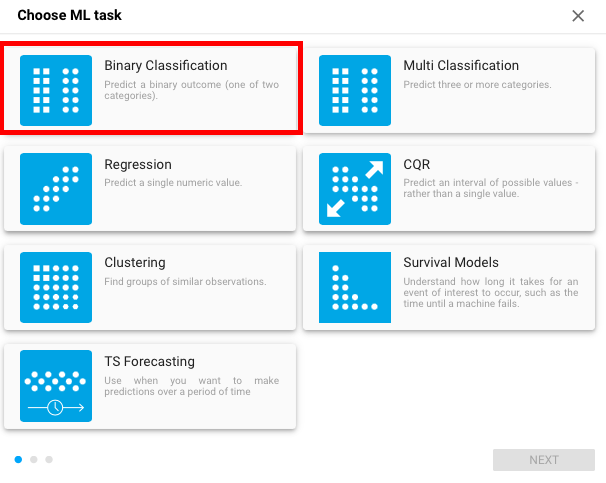

papAI provides all the essential tools for performing machine learning tasks without requiring any coding. For our purpose of predicting credit card eligibility, which is a binary classification problem, we only need to choose the appropriate ML task. In this case, the most suitable approach is binary classification.

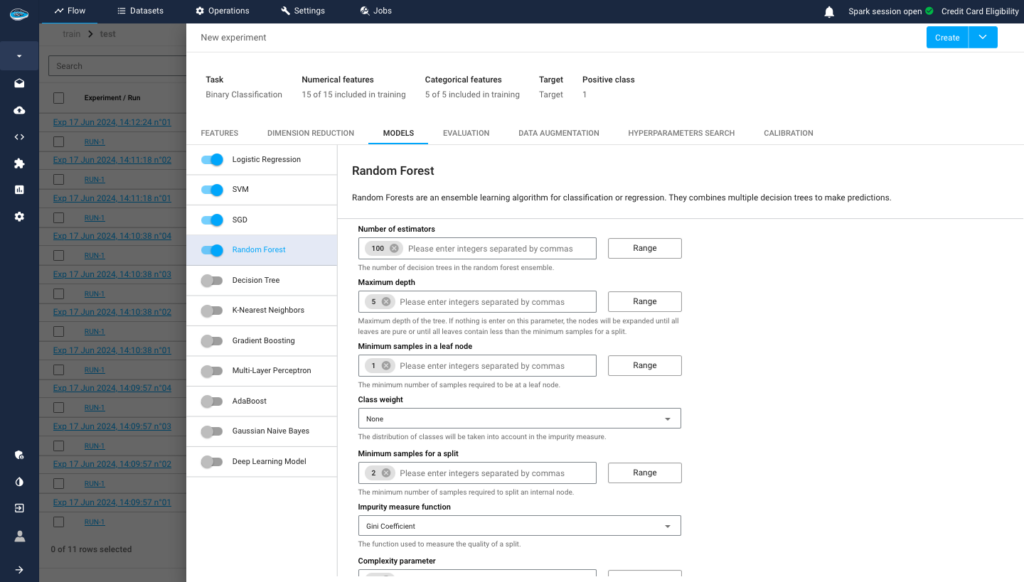

Following that, we select the algorithm or algorithms we want to employ. papAI provides the most frequently utilized ones.

4- Model Evaluation and Interpretation:

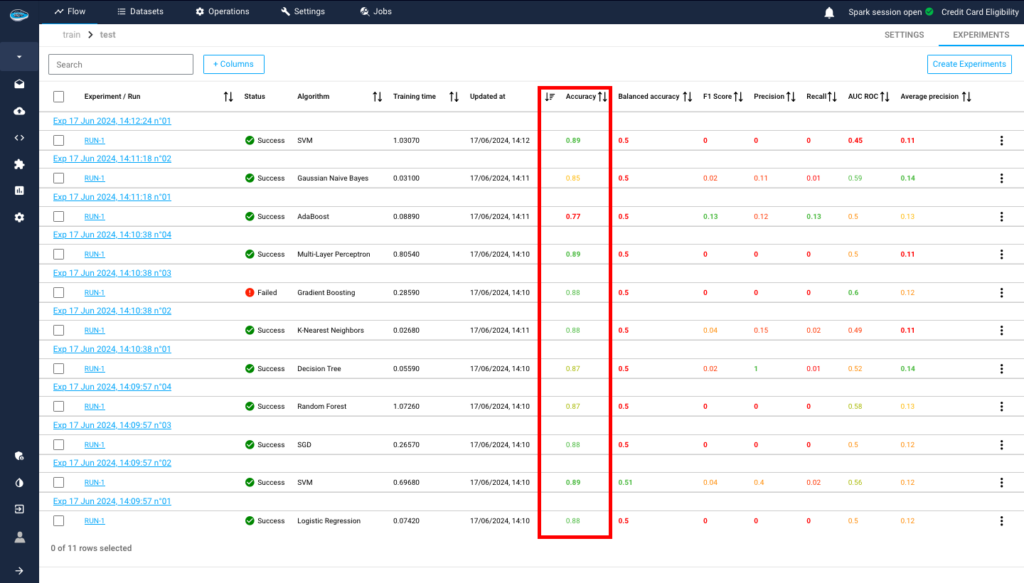

Now that we have finished the training, we will have the results for each algorithm. We choose the one with the best results; here the accuracy is the most important factor.

Accuracy is crucial because it measures the proportion of correct predictions out of all predictions, providing a straightforward and intuitive assessment of the model’s overall performance. For example, when the class distribution is balanced, we use accuracy as the primary metric. However, if our priority is to minimize false positives, we should use precision. If minimizing false negatives is more important, we should focus on recall. Thus, based on our dataset and specific needs, we should choose the metric that aligns best with our objectives.

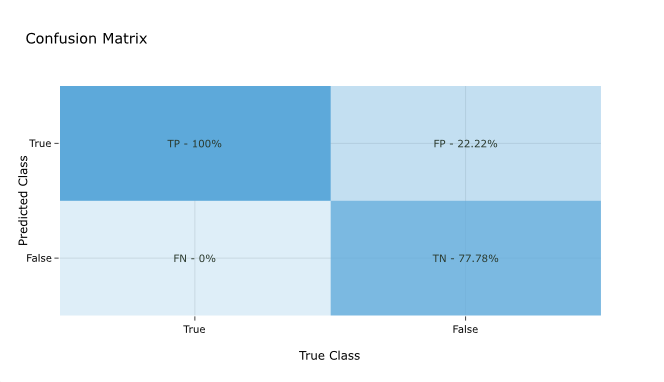

We now examine our model in more detail. A critical phase in the validation of a model is analysing the correlation between the expected and actual values. This entails using a confusion matrix to assess the model’s performance for binary classification.

The confusion matrix displays the counts of true positive (TP), true negative (TN), false positive (FP), and false negative (FN) predictions. By analyzing the confusion matrix, we can assess how well our model distinguishes between the two classes, providing insights into its accuracy and reliability.

In our confusion matrix, we can observe the following:

- True Positives (TP): Instances correctly predicted as positive (100%).

- True Negatives (TN): Instances correctly predicted as negative (77.78%).

- False Positives (FP): Instances incorrectly predicted as positive (22.22%).

- False Negatives (FN): Instances incorrectly predicted as negative (0%).

This evaluation reveals the model’s strengths and weaknesses, guiding us in further refining and improving its predictive capabilities.

Creating Your Own Credit Card Eligibility Model using papAI

By leveraging the powerful AI and machine learning capabilities of papAI, you can develop a model that is not only accurate but also highly efficient. papAI’s platform simplifies the process of data integration, model training, and deployment, making it accessible even for those without extensive AI expertise.

With papAI, you can customize your model to reflect your business needs and regulatory requirements. The platform allows you to incorporate various data sources, including credit histories, transaction patterns, and behavioral data, ensuring a comprehensive evaluation of creditworthiness.

Experience firsthand how papAI can transform your data strategy by booking a demo with one of Datategy’s AI experts today. Let us show you how easy and effective creating your own AI predictive model can be.

Interested in discovering papAI?

Our AI expert team is at your disposal for any questions

AI’s Role in Translating Complex Defence Documentation

AI’s Role in Translating Complex Defence Documentation The defence sector...

Read MoreHow AI Transforms Technical Documentation in Medical Devices and Life Sciences

How AI Transforms Technical Documentation in Medical Devices and Life...

Read MoreDatategy and Alpha X Join Forces to Strengthen AI-Driven Governance Across EMEA

Datategy and Alpha X Join Forces to Strengthen AI-Driven Governance...

Read More